January 2023 Market Trends Report

The U.S. economy added 223,000 jobs in December while the unemployment rate moved down to 3.5 percent, according to the U.S. Bureau of Labor Statistics (BLS) Employment Situation Summary.

Construction led the way for job growth among industrial sectors in December. The construction industry saw employees on payrolls grow by 28,000 in December. Construction employment rose by 19,000 per month in 2022, up from 16,000 per month in 2021.

According to BLS, employment in manufacturing changed little (+8,000) as job gains in durable goods (+24,000) were offset by a decrease in nondurable goods (-16,000). In 2022, manufacturing employment grew by 32,000 jobs per month compared to 30,000 per month in 2021.

Meanwhile, employment in transportation and warehousing changed little (+5,000). Air transportation added 3,000 jobs over the month, while employment continued to trend down warehousing and storage (-3,000). In 2022, average job growth in transportation and warehousing was just 17,000 jobs per month, compared to 36,000 in the bounce-back year of 2021.

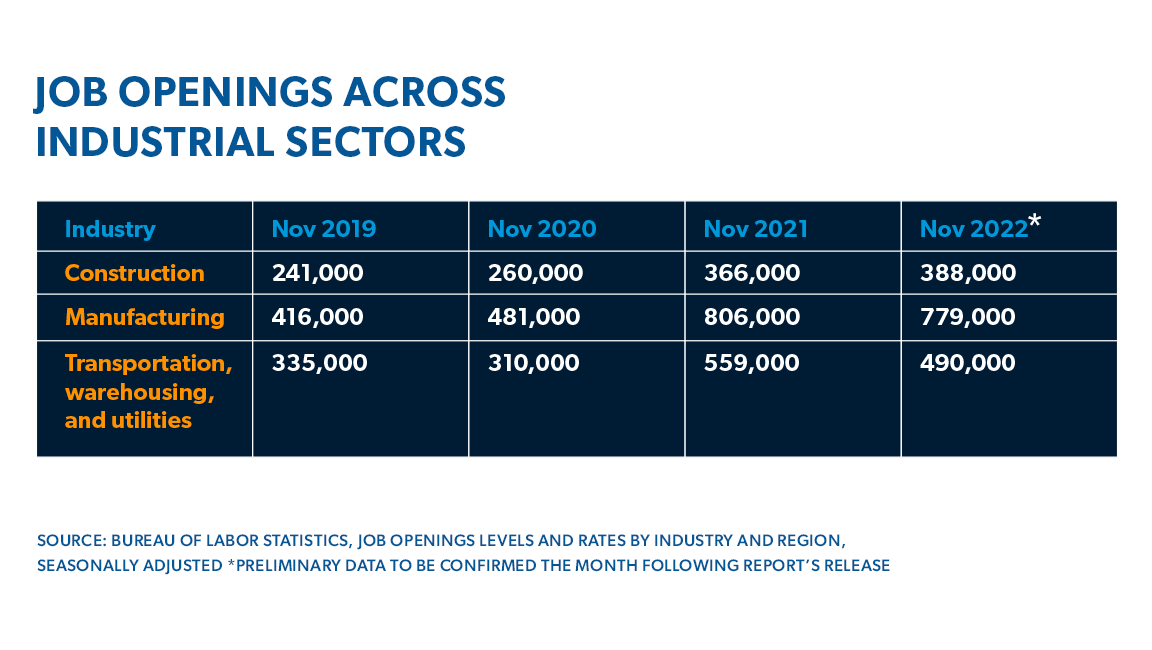

JOLTS Report shows job openings remain high across industrial sectors

The latest Job Opportunities and Labor Turnover Survey (JOLTS) report, which runs a month behind the BLS Employment Situation Summary, showed there were 10.46 million job openings on the last business day of November. As a share of the labor force, job openings remained at 6.4%, indicating demand for workers is still high, according to CNBC.

In November, job openings increased in manufacturing (+57,000) and moved little in both transportation, warehousing and utilities (-22,000) and construction (-2,000).

Hires and quits fall in manufacturing & construction, rise in transportation, warehousing & utilities

Both manufacturing and construction saw sharp declines in hires and small declines in voluntary quits in November compared to October, according to BLS. Manufacturing hires fell from 438,000 to 339,000, while construction hires fell from 337,000 to 323,000. Meanwhile quits fell from 271,000 to 269,000 in manufacturing and from 158,00 to 138,000 in construction.

In transportation, warehousing and utilities, the opposite was true. Hires ticked up for transportation, warehousing and utilities employers from 500,000 to 610,000 in November, and quits also rose from 918,000 to 1,000,000, according to BLS.

Jobs Market Overview: December 2022

3.7%

Overall Unemployment Rate

The unemployment rate has held between 3.5% and 3.7% since March 2022.

223k

Jobs Added

Job growth in December included gains in industrial sectors including construction and manufacturing.

62.3%

Labor Force Participation Rate

The labor force participation rate has shown little net change since early 2022.

Source: Bureau of Labor Statistics, Employment Situation Summary (bls.gov/news.release/empsit.nr0.htm)

Industry Employment Trends

OVERALL ECONOMY

+223k

Monthly Job Change

(+3.0% YoY Difference)

| Industry | Monthly Job Change | YoY Difference |

| Manufacturing | +8k | +3.0% |

| Automotive | +7.4k | +5.5% |

| Warehouse & Storage | -3k | +0.7% |

| Architectural & Engineering | +2.4k | +4.9% |

| Construction | +28k | +3.1% |

| Consumer Services | +85.2k | +3.8% |

Source: Bureau of Labor Statistics, Employment Situation Summary

Spotlight: The Year Ahead

As 2023 begins, demand for employees remains high despite months of speculation that a labor market cool-down is coming. Don’t take our word for it:

Indeed Hiring Lab says: “The US labor market remains on fire. The flames may have receded a bit from the highs of the initial reopening of the economy, but demand for workers remains robust and workers are seizing new opportunities. By any measure, the new data from this report shows a tight, hot labor market.”

Ron Hetrick, a senior economist at labor market analytics firm Lightcast, told the New York Times: “The people shortage is systemic, and it’s fundamentally changing how businesses should prepare for economic slowdowns… If the U.S. does see some sort of recession in 2023, it will be less about persistent worker displacement and more about employers finally being able to fill the roles they’ve had open for the past several years.”

Many remain convinced that some form of slow down will be coming. When that happens remains the question.

Jerome H. Powell, the chair of the Federal Reserve, said in a speech on Nov. 30 that signs of elevated “labor market tightness emerged suddenly in mid-2021” and the balance between supply and demand in the labor market has yet to be restored. Powell said: “Looking back, we can see that a significant and persistent labor supply shortfall opened up during the pandemic—a shortfall that appears unlikely to fully close anytime soon.”

Powell points to a couple reasons for the gap between available employees and job openings. Some of the participation gap, he said, “reflects workers who are still out of the labor force because they are sick with COVID-19 or continue to suffer lingering symptoms from previous COVID infections ("long COVID").” But he also pointed to recent research by Fed economists that points to excess retirements, which might now account for more than 2 million of the 3.5 million shortfall in the labor force.

What does it all mean for employers and workers as 2023 begins?

It means “workers are expecting more money than ever on the job,” according to the latest data from the Federal Reserve Bank of New York’s Center for Microeconomic SCE Labor Market Survey. The lowest average wage Americans are willing to accept for a new job, according to the survey, increased from $72,873 in July to the highest reading ever -- $73,667 in November. The increase was most pronounced for respondents below age 45.

It also means workers want opportunities to learn new skills and management that cares about them, among other incentives.

If you’re a worker looking to make the most of your job search or represent a business and are looking for a partner to help you navigate the hiring market, contact Aerotek today.

Source: U.S. Bureau of Labor Statistics, JOLTS Report for November 2022

Spotlight: The Aerotek Take

“Rumors of the labor market’s demise are greatly exaggerated. We continue to see high demand for talent from employers and workers are on the move. As competition remains high, it’s critical that both businesses and talent have a partner on their side throughout the hiring process. Like every year, 2023 will include its labor market ebbs and flows. Our job is to help steady the boat and allow our clients and contractors to focus on long-term growth.”

Bill Ruff, Vice President of Strategic Sales